Powell just cut rates. That move ripples far beyond the bond market, it compresses yields everywhere. Savings accounts, treasuries, and money market now offer barely 1-2%. For traditional investors, the playbook for diversification is no longer works.

Historically, spreading capital across bonds, equities and real estate smooth returns.

Traditional Yield Diversification

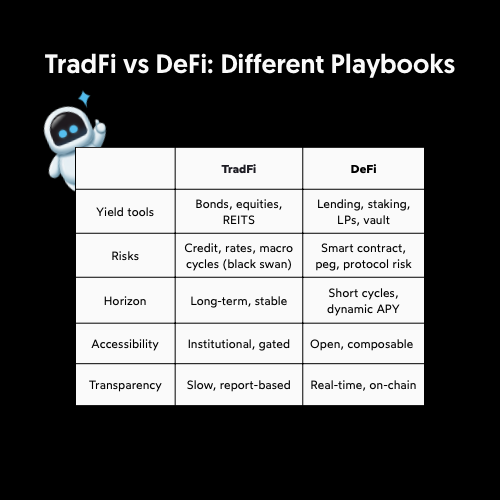

In TradFi, yield hunters diversify by:

Splitting bond allocations across governments, corporates, and high-yield, balancing safety with risk.

Collecting steady dividends (yield) from equities in mature, slow-cashflow sectors.

Adding exposure to real estate income streams, whether direct rentals or listed REITs.

Rounding out returns via commodities or structured income funds.

The idea? Reduce concentration risk, smooth returns, and hedge against cycles.

But limitations exist: Powell deciding to cut interest rates, the housing crisis (the great 2008), a new COVID variant, all examples where:

Assets often correlate in downturns.

Absolute yields shrink in low-rate regimes. (measly 1-2%)

Liquidity is slower, and transparency is limited.

In fact, relying heavily on traditional yields hasn’t been the best choice, as cash yields have declined since the first rate cut in September 2024.

So where should investors look for higher-yield products in this environment?

DeFi Yield Diversification

In DeFi, the concept of diversification enters new dimensions, instead of sectors or geographical concerns (or shall we say multi-dimensional).

Yield hunters now have access to:

Lending markets: Generate APY from supplying capital on protocols like

Staking: Lock $ETH or use liquid staking tokens for sustainable validator rewards. (stETH, mSOL, etc)

Liquidity provision: Provide depth on DEXes and earn through fees + incentives.

Aggregators and vaults: Optimize deployment automatically (@Yearnfi, @Beefyfinance, @HyperliquidX).

Structured strategies: Earn from option premiums, rate swaps, or yield tokens (e.g. Pendle YT/PT).

Here are some ways yield hunters reduce their risk:

Protocol spread (hedging smart contract risk across multiple venues).

Chain spread (Ethereum, Solana, Base, L2s, etc, avoid concentration).

Yield type mix (fixed vs variable, fee-based vs inflationary reward).

Asset exposure (stablecoin yields vs volatile token strategies).

Strategy mix (directional vs delta-neutral).

The risks are equally distinct: instead of corporate defaults or sovereign debt crises, investors face smart contract exploits, depegging stablecoins, and vanishing liquidity pools.

TradFi vs DeFi: Contrasts in Practice

In TradFi, yield diversification smooths returns over decades.

In DeFi, it often manages risk over weeks or even days, where incentives and market conditions evolve much faster.

Where TradFi investors track creditworthiness, DeFi investors audit protocol security.

Where TradFi looks at duration matching, DeFi considers chain risk and composability.

TL:DR

The search for yield is changing. Traditional income streams are shrinking, but DeFi is expanding - with lending TVL already topping $53B, up 72% this year. The opportunity is real, but so are the risks: smart contract exploits, depegs, and vanishing liquidity pools.

That is why the future of yield hunting is hybrid: blending the stability of traditional markets with the innovation and flexibility of DeFi.

Bellve exists to make that shift seamless. Our AI-driven yield agents diversify across chains and protocols automatically, manage risk dynamically, and give investors real-time transparency. No more manual yield hunting, no more spreadsheets, just deposit, set, and let Bellve work.

In a low-rate world, Bellve is how investors unlock higher yields safely.

Try it yourself -> bellve.com

(Sources: DeFiLlama; Binance Research, August 31, 2025)